A Biased View of Hiring Accountants

A Biased View of Hiring Accountants

Blog Article

The Facts About Hiring Accountants Uncovered

Table of ContentsThe Facts About Hiring Accountants UncoveredUnknown Facts About Hiring AccountantsMore About Hiring AccountantsThe 9-Minute Rule for Hiring AccountantsHow Hiring Accountants can Save You Time, Stress, and Money.

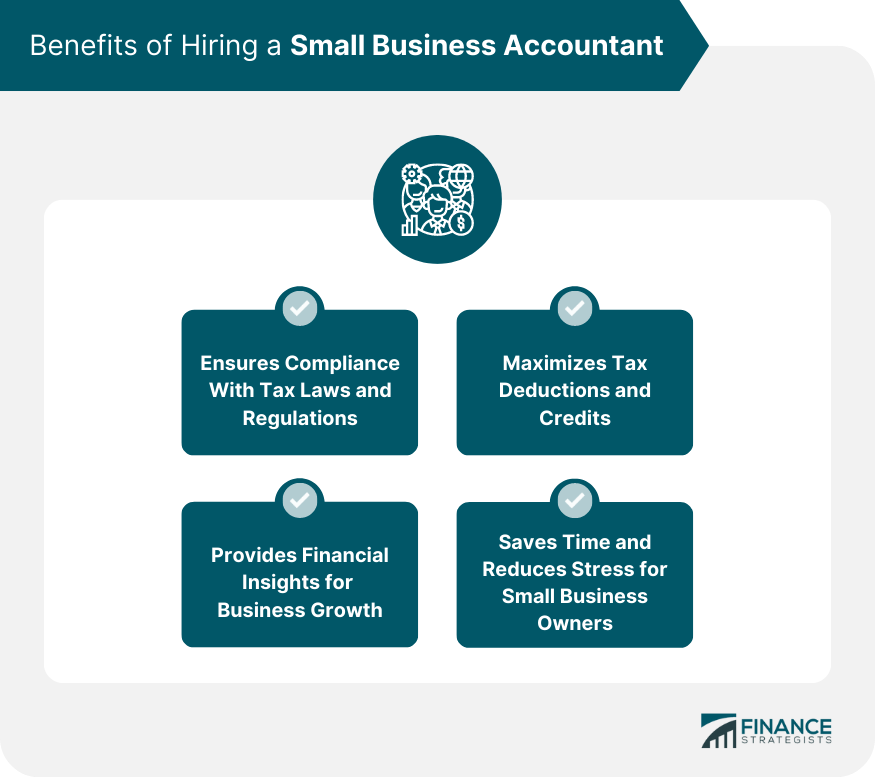

Is it time to work with an accountant? From improving your tax returns to evaluating funds for boosted success, an accountant can make a huge difference for your company.An accountant, such as a licensed public accountant (CPA), has specialized understanding in financial administration and tax compliance. They keep up to date with ever-changing guidelines and best practices, ensuring that your organization continues to be in conformity with lawful and regulatory needs. Their understanding enables them to browse intricate financial matters and give exact dependable recommendations customized to your specific business requirements.

For those that don't already have an accounting professional, it might be tough to know when to get to out to one. Every business is different, but if you are encountering obstacles in the complying with areas, currently might be the best time to bring an accountant on board: You don't have to write a service strategy alone.

Hiring Accountants Can Be Fun For Anyone

The stakes are high, and an expert accounting professional can assist you obtain tax obligation suggestions and be prepared. We recommend speaking to an accountant or various other money specialist regarding a number of tax-related objectives, including: Tax obligation preparation methods.

By collaborating with an accounting professional, services can reinforce their lending applications by offering more exact economic info and making a much better situation for monetary viability. Accounting professionals can likewise assist with tasks such as preparing economic documents, examining economic data to examine credit reliability, and creating an extensive, well-structured lending proposition. When things transform in your business, you want to make certain you have a strong manage on your financial resources.

Are you ready to market your company? Accounting professionals can aid you identify your company's worth to help you safeguard a fair offer.

Some Known Questions About Hiring Accountants.

Individuals are not required by legislation to keep financial publications and records (businesses are), but not doing this can be a pricey blunder from a monetary and tax blog point of view. Your checking account and credit card statements may be wrong and you might not find this till it's as well late to make improvements.

Whether you require an accountant will certainly most likely depend upon a few factors, including just how complicated your tax obligations are to file and just how several accounts you need to manage. This is a person who has training (and likely an university degree) in audit and can take care of bookkeeping chores. The hourly price, which once again depends on area, task description, and know-how, for a self-employed accountant is regarding $35 per hour generally yet can be substantially much more, also up to $125 per hour.

The Best Strategy To Use For Hiring Accountants

While a certified public accountant can give bookkeeping solutions, this professional may be too pricey for the task. Hourly fees for Certified public accountants can run about $38 per hour to start and enhance from there. (Many CPAs do not click this link deal with accounting services directly yet utilize a staff member in their company (e.g., a bookkeeper) for this job.) For the jobs described at the start, a personal accountant is what you'll require.

It syncs with your bank account to streamline your personal funds. You can work with a bookkeeper to aid you get started with your individual audit.

You make a decision to manage your personal accountancy, be sure to divide this from audit for any type of business you have.

The Hiring Accountants Diaries

As tax obligation season strategies, people and companies are confronted with the perennial question: Should I tackle my tax obligations alone or hire a specialist accounting professional? While the attraction of saving cash by doing it yourself may be appealing, there are compelling reasons to consider the expertise of a qualified accountant. Here are the leading factors why working with page an accountant may be a sensible investment compared to navigating the complicated world of taxes on your very own.

Tax obligations are intricate and ever-changing, and a seasoned accountant remains abreast of these changes. Their experience makes certain that you benefit from all readily available deductions and credits, inevitably maximizing your possible tax obligation cost savings. Finishing your own tax obligations can be a lengthy and labor-intensive procedure. Employing an accountant maximizes your time, enabling you to concentrate on your individual or company tasks.

Report this page